atc income tax india

Public Notice regarding fraudulent appointment letter. ATC Income Tax is a tax preparation firm with retail offices throughout the Atlanta Metro Area.

Charge of income-tax Section 5.

. The amount of the advance - 200 to 500 - will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer. Find your nearest ATC Income Tax offices and make an appointment today. Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax.

आज क इस आरटकल म म आपक आय कर अधनयम 1961 PDF Income Tax Act 1961 PDF download क हद व इगलश दन PDF उपलबध करन ज रह ह जनह. Air Traffic Control is one of the most stressful jobs in the world. Since PPF is backed by the government it is one of the safest investment cum tax saving options in India.

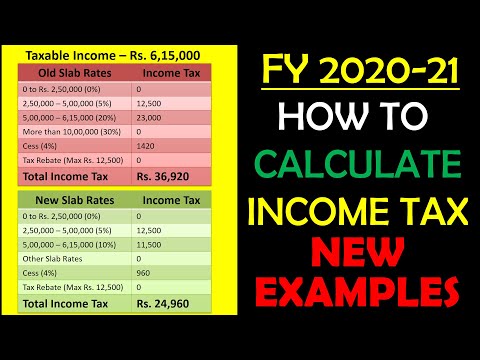

2 Act 2020 and applicable for AY. Article is been prepared keeping in view the amendments made by Finance No. 21 This Act may be called the Income-tax Act.

42022 - Deduction of Tax at Source - Income-tax Deduction from Salaries under section 192 of the Income-tax Act 1961. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Guidelines under clause 10D section 10 of the Income-tax Act 1961.

As a tax-saving investments plans the bank FD offers tax-free income. Bank FD offers guaranteed return on investment to the individuals and also ensures the safety of investment as the amount invested gets locked in up to the. Insertion of rule 16DD and form 56FF to the Income-tax Rules 1962.

PPF is a great tax saving option as it qualifies for deduction upto Rs 15 Lakhs per annum under section 80C of the Income tax act. Chapter XIV Sections 139 to 158 of the Income Tax Act 1961 deals with the provisions related to procedure for assessment. For JE-ATC this can be approximately INR 8000 Income tax will be depending on how much.

Income deemed to accrue or arise in India. Residence in India Section 7. Section 151 of IT Act 1961 provides for sanction for issue of notice.

The national electric grid in india has an installed capacity of 393389 gw as of 31 december 2021. Additionally it has provided decent returns in the 7 9 range. It allows for a maximum deduction of up to Rs15 lakh every year from an investors total taxable income.

ATC is a premier tax preparation firm with a core focus in tax services. Atc Income Tax India. 1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Income Tax Gratuity Social Security Schemes and Pension do remember all AAI employees get Pension after retirement. INCOME-TAX ACT 1961 43 OF 1961 AS AMENDED BY FINANCE ACT 2008 An Act to consolidate and amend the law relating to income-tax and super-tax BE it enacted by Parliament in the Twelfth Year of the Republic of India as follows CHAPTER I PRELIMINARY Short title extent and commencement.

Income deemed to be received Section 8. Recently we have discussed in detail section 150 Provision for cases where assessment is in pursuance of an order on appeal etc of IT Act 1961. Dividend income Section 9.

May 10 2020 the income tax act brings to tax such liabilities which are no more payable. MUMBAI Feb 1 Reuters - India will impose a tax of 30 on income from cryptocurrencies and other digital assets finance minister Nirmala Sitharaman said while presenting the federal budget on. Section 80C of Income Tax Act is applicable only for individual taxpayers and Hindu Undivided Families.

Apportionment of income between spouses governed by Portuguese Civil Code Section 6. Our primary focus is in individual and business tax returns. Scope of total income Section 5A.

This plan is best suitable for individuals who have a low-risk appetite and want to save money over a long-term period. Here comes the real reward of being an ATC Officer in India. This article discusses in brief about Income which are exempt from Tax under Income Tax 1961 and covers Income Exempt under Section 10 1 to Section 10 49.

Incometax Twitter Search Twitter

Incometax Twitter Search Twitter

Atc Income Tax Office In The City Tirupati

Gowtham Co Tax Consultants Home Facebook

Incometax Twitter Search Twitter

Air Traffic Controller Salary In India Aai Atc Salary

How Is Taxable Income Calculated

How Is Taxable Income Calculated

What Is The In Hand Salary Of A Newly Recruited Aai Je Airport Operations Quora

Income Tax Return Filing A List Of I T Rules That Have Changed This Year

Income Tax Return Filing A List Of I T Rules That Have Changed This Year

Air Traffic Controller Salary In India Aai Atc Salary

Atc Accounting Tax Consultants Business Management Consultant In Raipur

Checklist For Indian It Professionals Filing Individual Income Tax Returns Aotax Com

Income Tax Return Filing A List Of I T Rules That Have Changed This Year

Atc Income Tax Reviews Photos Phone Number And Address Legal Services In Georgia Nicelocal Com